While investments in institutional sales saw a decline of 37 % over last year, private equity investment in real estate in India increased by 7% in 2012 and was noted at Rs 6,200 crore.

"Investment in ready income generating / operational office assets have gained strength over the last few years due to lower risk and steady cash flows associated with this type of investment.

With increase in number of high value transactions in this sector, the market is moving towards a mature phase,"said Sanjay Dutt, Executive Managing Director, South Asia, Cushman & Wakefield,

Majority of the Private Equity in Real Estate (PERE) investments were noted in ready income generating / operational office assets at Rs 3230 crore, an increase of 34% over 2011. Under construction residential projects continued to witness the highest number (25) of PERE deals valued at Rs 2850 crore in 2012.

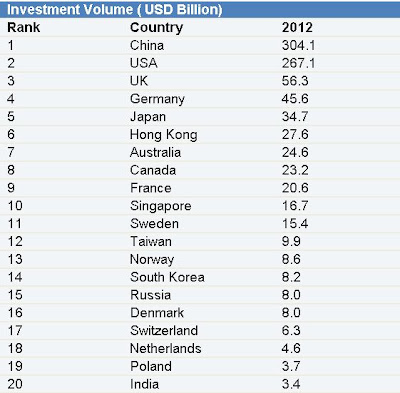

Global Property investment market recorded a modest 6% rise in activity during 2012 with volumes reaching US$929bn. China remained the largest global investment market overall due to surge in land sales seen in late 2012 followed by US and UK respectively. " In what was a difficult year in most markets, investment volumes rallied in Q4 signaling the beginning of real momentum and a return of confidence in the market which could see volumes this year increase 14% to exceed $1 trillion for the first time since 2007," mentioned the report.

"Investment in ready income generating / operational office assets have gained strength over the last few years due to lower risk and steady cash flows associated with this type of investment.

With increase in number of high value transactions in this sector, the market is moving towards a mature phase,"said Sanjay Dutt, Executive Managing Director, South Asia, Cushman & Wakefield,

Majority of the Private Equity in Real Estate (PERE) investments were noted in ready income generating / operational office assets at Rs 3230 crore, an increase of 34% over 2011. Under construction residential projects continued to witness the highest number (25) of PERE deals valued at Rs 2850 crore in 2012.

Global Property investment market recorded a modest 6% rise in activity during 2012 with volumes reaching US$929bn. China remained the largest global investment market overall due to surge in land sales seen in late 2012 followed by US and UK respectively. " In what was a difficult year in most markets, investment volumes rallied in Q4 signaling the beginning of real momentum and a return of confidence in the market which could see volumes this year increase 14% to exceed $1 trillion for the first time since 2007," mentioned the report.